Tag: options

-

Bear Call Spread option strategy

A Bear Call spread is a hedged risk options strategy created by buying an OTM(Out of The Money) call option and selling an ATM (At The Money) call option. This strategy is useful when you are bearish on the market, so you would want to benefit from a falling market price by selling a Call…

-

Bull Call Spread Option strategy

Bull Call Spread is arguably one of the best strategy to take advantage of bull run without exposing yourself to huge risk. We explain the details of this strategy so you can start your option journey.

-

Best option strategy for low capital

Do you think options is for very rich people with large capital? In this article we explore low capital options strategy which can be used by beginners to get started in options trading.

-

Low Risk Option Strategies: How to Navigate the Market with Confidence

Are you scared of options because of the risks but want to profit from the flexibility of options to make profits, irrespective of market directions? In this article, we explore the low-risk option strategies, which can kick-start your options journey with well-defined risks.

-

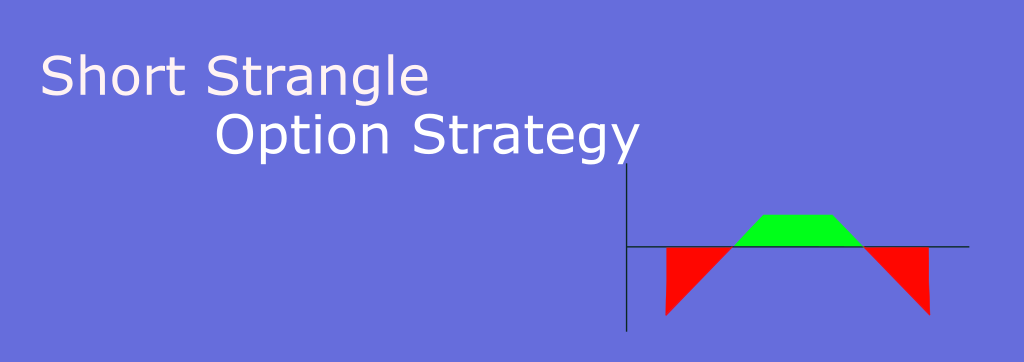

Short Strangle Option selling strategy

This is an advanced option trading topic, and assumes you are familiar with basic options terms, if you are starting of with option, please read our option primer. Short Strangle is possibly the most popular option selling strategy for non directional market. Similar to Short Straddle, it consists of selling a Put option and a…

-

Options: What is ATM, ITM, OTM?

If you have just started with options, you would have heard these terms being used to refer to different strikes. These term define the money-ness of the options or in other words, how much money the buyer stands to make at expiry if the market expires at its current position. The money or profits are…

-

Risk free option strategy: Do they exist?

Who does not want a insanely high return and risk free investment strategy? I know I do and I am sure you do as well. So lets see if there are any high return and low risk opportunities with Options trading. First, let us understand why do we expect returns on any investments. Lets start…

-

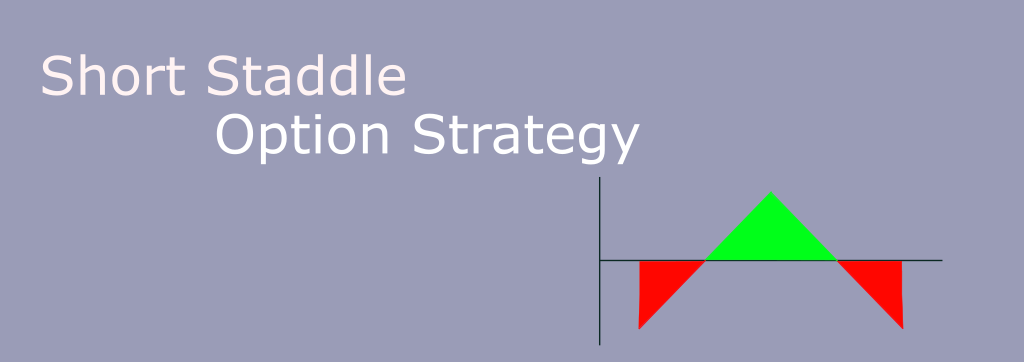

Short Straddle Option Selling Strategy

Short Straddle is the simplest non directional option selling strategy. It comprises of selling a call option and a put option at ATM strike. It is used when the seller is expecting the market to stay at one place and does not expect lot of movement in the market. Understanding short straddle Since a short…

-

European option vs American option

Confused about various options style? then read on, as we explain various option styles and how they work.

-

What are Call (CE) Options?

This article assumes that you are familiar with options basic, If you are starting with options, make sure to check out our option primer. What is a Call Option? A Call option usually denoted by CE, is a type of contract between buyer and seller to buy a pre determined quantity of Shares at a pre…